Filing an income tax return fills most people with dread.

For clients of Coast Mental Health, the process is often paralyzing — even though many of them are actually eligible for a rebate.

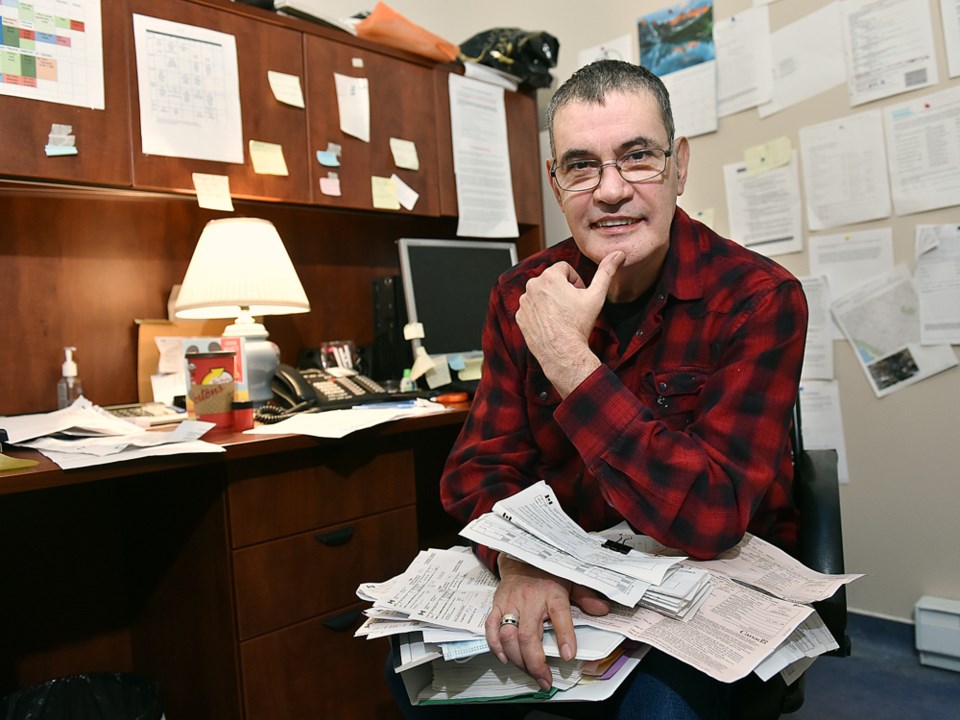

That’s where Michael Faithfull and his small team of Coast Mental Health peer support workers come to the rescue.

Last year, they filed a record 630 tax returns and this year is promising to be even busier.

“With people who are anxious, I sit them down, calm them down and try to bring some humour into it,” says Faithfull, who works out of a cramped and file-filled office at Coast’s Seymour Street resource centre.

Asked why many people on social assistance don’t file even though it can be to their advantage, he says it’s the added stress and anxiety that comes from dealing with paperwork and bureaucracy, as well as an unfounded fear they owe taxes.

The average income of his clients is $12,000 a year — up from $11,200. It was the first rate increase for people on disability since 2002.

They get an average of $100 quarterly and a one-time sales tax refund of $75. Even if they have an additional source of income, it’s often to their advantage to file.

Faithfull started doing taxes five years ago. He started with 10 returns in a building that houses 86 residents. Word got around of the service — and the rebate — and the number doubled the next year. It’s been steadily increasing ever since.

Faithfull expects even more clients this year, in part because of a loss of advocacy positions among other agencies. Many places have stopped offering the service.

“We’re the only place that says you can come any time in March or April and we’ll file it on time,” he says. “It’s a service that’s necessary and important. It’s missing [at other agencies], especially in the Downtown Eastside.”

For those who haven’t filed for a few years, they have to wait until after the April 30 deadline crunch because their returns take more time.

This will Faithfull’s last year on tax duty, however. On March 7 he turned 64 and he’ll soon be retiring as a peer support worker. But not to worry — he believes he has a replacement lined up.

Even though the next three months will be spent doing a job most people dread, Faithfull will miss his role.

“I’m grateful to have the opportunity to provide the service knowing people are happy and relieved,” he says. “They say ‘Thank you, Michael, I got my rebate.’ That’s my reward.”