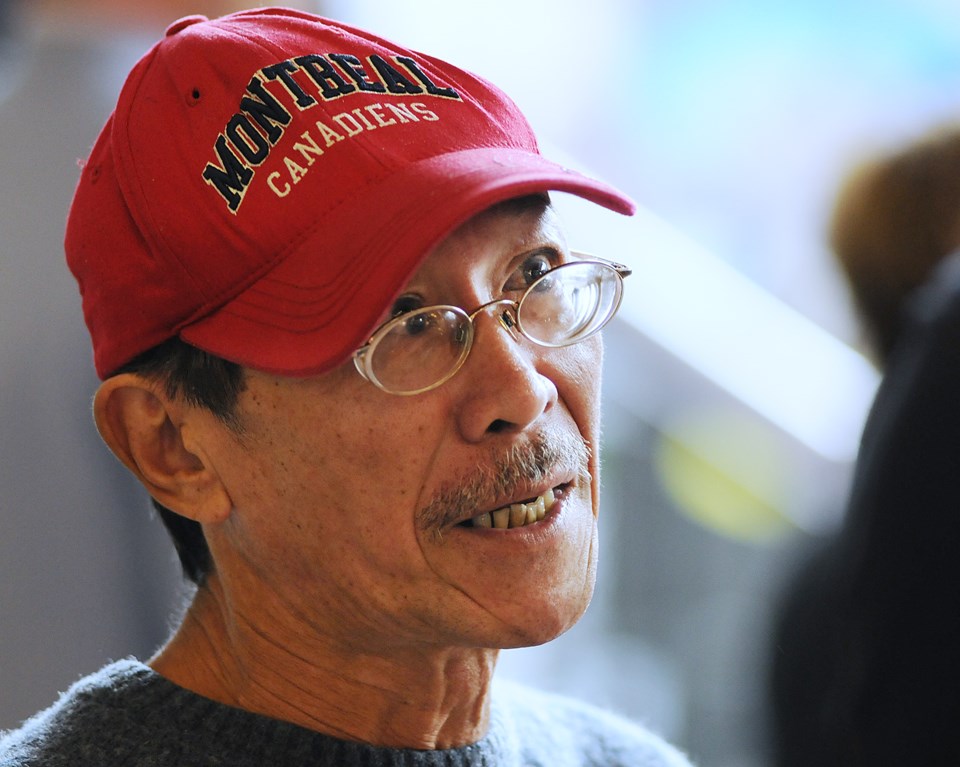

At 58, Rene Kwan hoped at this point in his life that he wouldn’t need to seek a loan from the city’s rent bank.

An accountant for 25 years, Kwan was forced to retire because he is losing his vision. His disability and other circumstances have left him living on a Canada pension of $550 per month.

“I worked hard and this is what I ended up with — $550 a month,” he said, noting his rent is $450 per month. “It’s sad.”

Kwan is the youngest of his family, some of whom lived in Canada and others in the Philippines. They’ve all since passed on, leaving Kwan by himself in an apartment at 23rd and Fraser.

He described his situation as being “stuck in the corner.”

Last fall, Kwan was referred to the city’s rent bank after visiting with a seniors advocate downtown. He filled out an application, met the criteria and was given a $500 loan.

It allowed him to avoid eviction. He praised the staff at the rent bank and said the service “saved his life for now.” The arrangement he agreed to with staff was to pay back $20 per month, interest free.

“I know it’s not that much, but it worked out with my problem issue,” he said of the $500 loan. “And the return amount [of $20 per month] is very humane.”

Kwan attended a press conference Tuesday that marked the one-year anniversary of the city’s rent bank. Since October 2012, the rent bank approved 137 interest-free loans, helping 228 people avoid being evicted from their homes. Staff counted 39 children among the recipients.

The total amount of loans was $124,171 and the average loan was $906. So far, 70 per cent of loans are being repaid in monthly instalments, although recipients have a maximum of 24 months to repay. Money is automatically withdrawn from a person’s account.

The reasons recipients have applied for a loan included underemployment, a health crisis, a family crisis, job loss, laid off and delays in receiving Employment Insurance. The majority of loans — 87 per cent — went to single-income households and 43 per cent to people 55 or older.

The highest demand for loans came from residents of the West End, Grandview-Woodlands, downtown, Hastings-Sunrise, Strathcona and Mount Pleasant. The average household income was $18,056.

Amanda Pollicino, managing director of the rent bank, said the data collected from recipients shows there is a growing need to support low-income renters. Pollicino said many single-income households like Kwan’s don’t qualify for provincial rental subsidy programs.

Pollicino said the popularity of the rent bank, which resulted in 250 applications processed from 600 enquiries, points to the need for a provincial program. Surrey and New Westminster have a rent bank but many municipalities in B.C. don’t, she added.

“We get a lot of requests from Burnaby, we get a lot of requests from North Vancouver, we get a lot of requests from Richmond,” she said, noting staff find it difficult to turn people away.

The rent bank was established to operate for three years. Its loan budget, which is funded by The Radcliffe Foundation, is $365,000 over three years. The City of Vancouver committed to $148,00 over three years for operating costs. The Vancouver Foundation contributed another $90,000 for operating costs.

Kwan, meanwhile, met with Vancouver-West End NDP MLA Spencer Chandra Herbert after the press conference to seek help in getting income assistance for his disability. If

Kwan is not eligible for funding, the Canadian citizen said he will consider returning to the Philippines.

“I don’t know where to go, or who can help me,” he said, before being introduced to Chandra Herbert, who attended Tuesday’s press conference.

mhowell@vancourier.com