Hey homeowners, time to dig into your wallets again – your property taxes are likely going up next year.

Same goes for business property owners.

I say likely because city council won’t vote on the proposed 3.9 per cent hike until Dec. 12 at a public meeting at city hall.

Expect some pushback from the NPA at that meeting, particularly from Coun. George Affleck. I can almost guarantee he will make his annual reminder to his friends from the ruling Vision Vancouver that homeowners and business property owners aren’t getting the full story on how their costs will go up next year.

Affleck always makes a point of mentioning how utility fees for sewer, water and solid waste have to be rolled into the total bill for taxpayers. He’s right, according to the city’s budget documents.

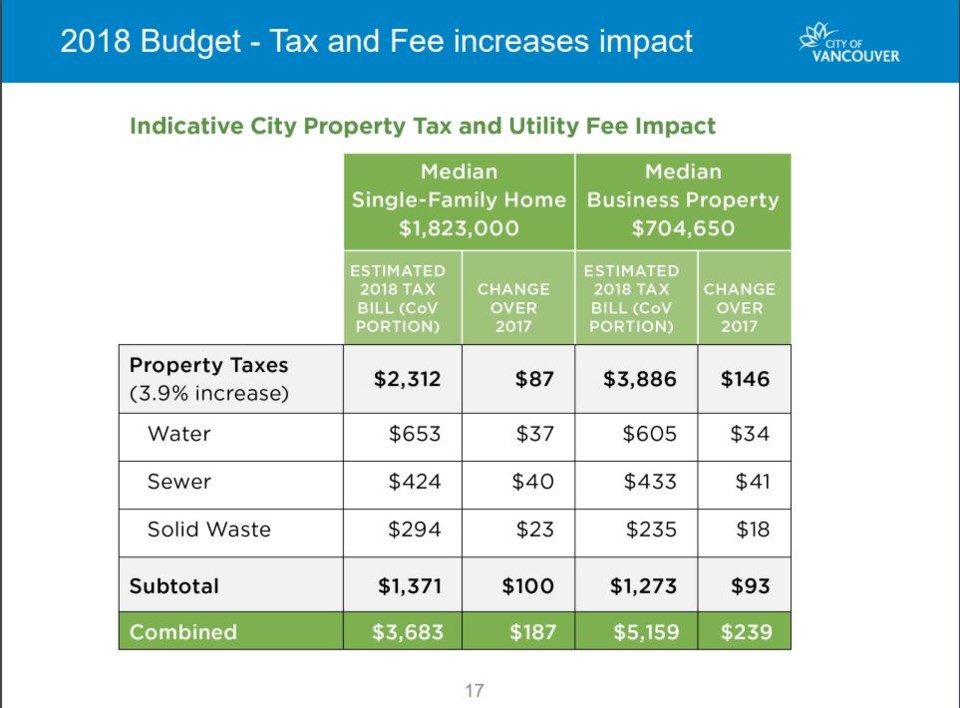

If I understand the math, here’s what the owner of a single-family home assessed at $1.8 million can expect to pay: an increase of $87 in property tax and an additional $100 in utility fees for a total of $187 per year.

So that person’s estimated tax bill will be $2,312. Add $1,371 in utility costs -- $653 for water, $424 for sewer, $294 for solid waste – and that person’s combined bill is $3,683.

For a business property assessed at $704,000, the 3.9 per cent tax increase coupled with increases in utility fees means a $239 hike. So that’s $3,886 in property taxes and $1,273 in utilities for an estimated bill of $5,159.

I’m going to guess, if you’re a property or business owner, that these increases suck.

Actually, let’s take the guess work out of this.

If you scroll way, way down to page 377 of the city’s 423-page budget document, you will learn that only 59 per cent of residents surveyed said they were satisfied with city services.

That was a 10 per cent drop from the previous year.

Only 45 per cent of business property owners said they were satisfied.

That was a nine per cent drop from the previous year.

Quite significant drops.

So what’s going on?

Patrice Impey, the city’s financial director, spoke to council Wednesday at a meeting to outline the proposed $1.4-billion budget. Impey said it was difficult to point to a reason for the decrease in residents’ overall satisfaction with city services but mentioned the Oct. 14 byelection.

The survey was done during the campaign.

“So just a sensitivity to city issues may have been more visible,” she said. “We also know that there are a number of really key issues that have been in the public around housing, the housing crisis, the opioid crisis and just a lot more visibility to that.”

Impey also talked about taxpayers’ tolerance for tax increases. The city’s survey showed the majority of residents and business property owners – 62 per cent on average – were willing to pay a one per cent tax increase to keep services at their current level.

You would be correct in concluding both groups’ willingness to pay higher taxes dropped significantly as bigger tax hikes were suggested. For example, only 22 per cent of residents were prepared to pay a three per cent increase, while only 19 per cent of business property owners said they would take the hit.

Another data point that could explain taxpayers’ overall satisfaction or dissatisfaction with city services is that the majority of respondents to the survey identified cost of living and housing as top issues for them.

In other words, it already costs enough to live/survive in one of the world’s most unaffordable cities, so why would I want to give you guys more money?

Griping about taxes has been a sport for property owners for decades, perhaps even centuries, as any distant relative of a feudal lord will tell you.

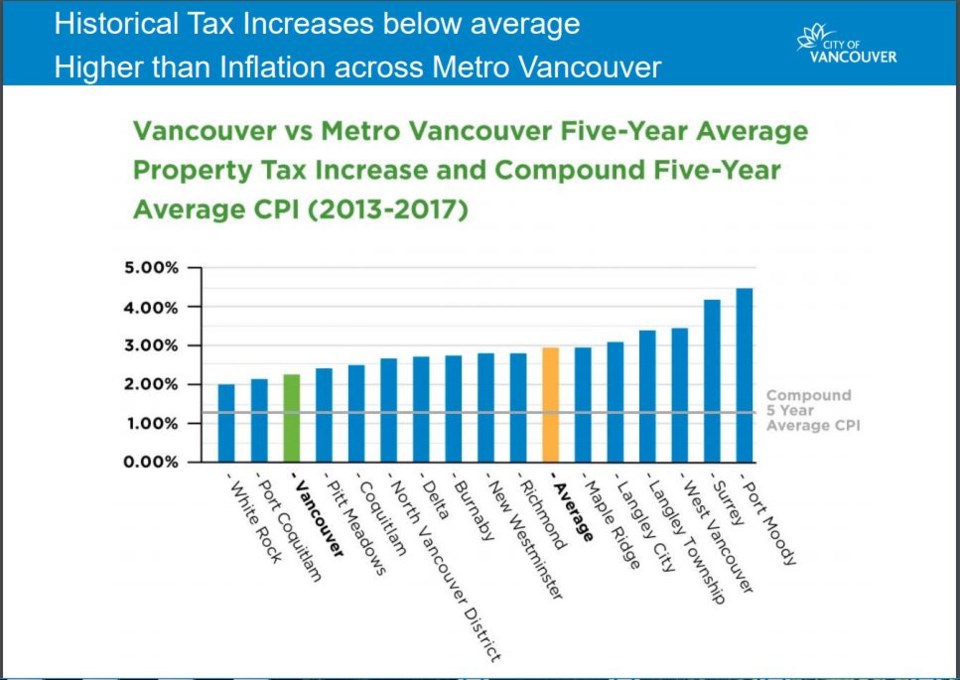

But keep in mind that griping is still being done even though Vancouver has had one of the lowest average property tax increases among Metro Vancouver municipalities – at 2.3 per cent – over the past five years.

So why the big hike this year?

Many reasons, but wage increases for police, firefighters and other union workers are driving the increase.

A graph Empey showed in her presentation indicated police have seen a 16.6 per cent wage increase between 2012 and 2017. It was 16 per cent for firefighters and 10.2 per cent for members of the Canadian Union of Public Employees.

The city anticipated those wage increases and considered them among the 3.3 per cent of existing costs going into the proposed 3.9 per cent tax hike. The new costs total $34.7 million.

They include $5.1 million for more staff to reduce wait times for development permits, $3.3 million to hire more police officers, $2.6 million to implement the empty homes tax and $2.9 million for improved safety and security at city facilities and parks, $700,000 for a “drug containment facility” for the Vancouver Police Department to handle fentanyl and another $700,000 towards the construction of an Indigenous healing and wellness centre.

But, you ask, isn’t some of that really capital budget costs?

I had a similar question last year and received an email from Impey with an explanation. Here’s what she wrote:

“The operating budget does fund portions of the capital budget through pay-as-you-go transfers for capital and principal and interest payments on debt. The capital budget is also funded from sources other than property tax, including utility fees, development cost levies and community amenity contributions from developers, special purpose reserves, internal loans, fees and levies collected from property owners and contributions from senior governments and other funding partners.”

If you voted in the 2014 civic election, you might recall voting on whether to give council the authority to borrow $235 million towards the 2015-2018 Capital Plan, which totalled $1.085 billion back then; it’s now $1.3 billion.

Any debt incurred by the city, except for utilities such as waterworks and sewers, requires approval of citizens. A majority of voters approved borrowing $235 million in the 2014 election.

So why does council have to approve this?

Impey: “Council votes on a capital plan, the electorate votes on borrowing authority for parts of the plan, and the direction to borrow funds is established when the capital budget is approved by council (annually or more frequent adjustments).”

Got it?

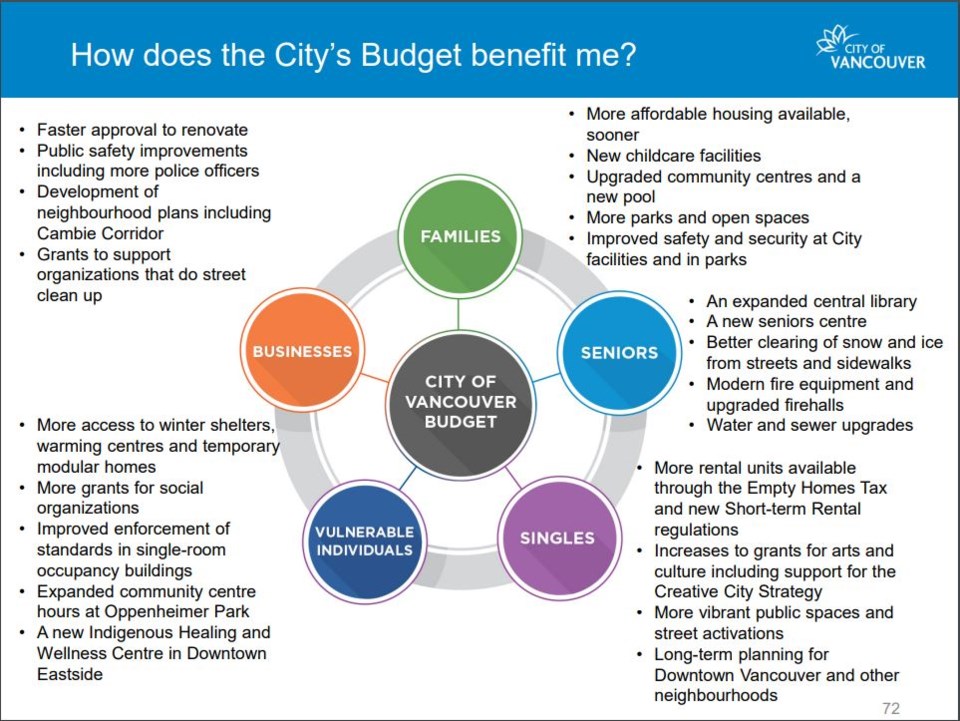

To understand more about how the budget does or doesn’t benefit you, I was going to write some more sentences that would include lots of numbers. Instead, I’ve decided to go all infographic on you and copy and paste this last slide from Impey’s presentation to council.

You could also go to the city’s website and read all 423 pages of the budget report for more details. For even more fun, you could show up at city hall at 9:30 a.m. on Dec. 12 and listen to the council debate.

Either way, it will better inform your griping.

@Howellings