The series of interest rates hikes and the pressures of the mortgage stress test are keeping a Metro Vancouver home out of the reach of many, according to Royal Bank of Canada’s latest housing affordability study.

The region’s high home prices are still at a “crisis-level affordability” when compared with local incomes, despite home prices flatlining and even dropping in some areas and property types, reported the bank.

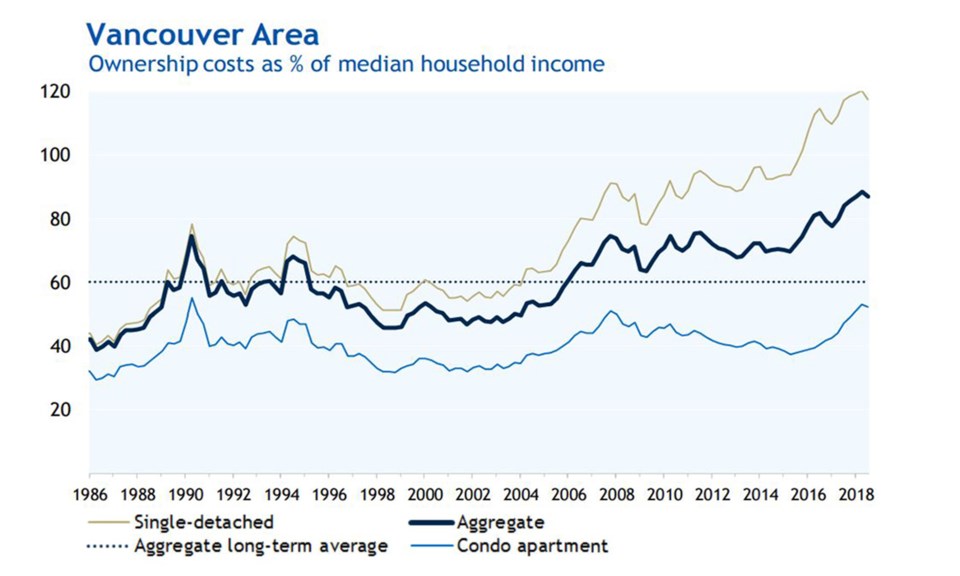

RBC’s affordability index for the Vancouver Census Metropolitan Area in 2018’s third quarter was 86.9 per cent, which is 1.7 percentage points lower than the previous quarter, but still close to the record high.

An index of 86.9 per cent means that a person with an average local income would have to spend 86.9 per cent of that income on housing costs to buy an average priced home (aggregate of property types, assuming a 20 per cent down payment).

Single-detached homes were even higher than that, at nearly 120 per cent, while even the average condo was unaffordable at well over 50 per cent of local earnings.

In order to pass the mortgage stress test and service a mortgage on an aggregate-priced home in Metro Vancouver at an affordable level, the income required was a whopping $211,000 in the third quarter.

RBC said in its report, “The home ownership bar is still incredibly high for [Metro] Vancouver buyers – pretty much the highest it’s ever been in Canadian history… Crisis-level affordability weighed heavily on the market this year. Resale activity plunged 31 per cent from a year ago with few signs so far that the bottom has been reached. Demand has weakened so much that the few buyers out there are now able to get some price concessions from sellers. We expect prices to decline somewhat in 2019.”

However, the bank added that it expected affordability levels to stay approximately where they are, despite falling prices, as they will be largely cancelled out by further interest rate increases.The report said, “We expect the Bank of Canada to hike the overnight rate two more times next year, which will sustain upward pressure on ownership costs. Still, we don’t think that affordability is set to erode significantly either. A generally soft environment for prices and rising household income will contain some of that pressure.”

Nationwide, the affordability index increased to its worst level in Canada since 1990, when interest rates were extremely high. A key reason for the near-record levels is that while Vancouver and Toronto’s indexes have barely improved, other major cities – especially Montreal – are deteriorating.

RBC said of the national index, “It would have taken 53.9 per cent of a typical household’s income to carry the ownership costs of average home bought last quarter. This is up 1.5 percentage points from a year ago.”

RBC’s affordability index compares local average incomes with local average home prices, but it does not take into account any private wealth, non-local incomes, equity built up by the approximately 65 per cent of Metro Vancouverites who own a home, or generational wealth transfer to younger buyers.